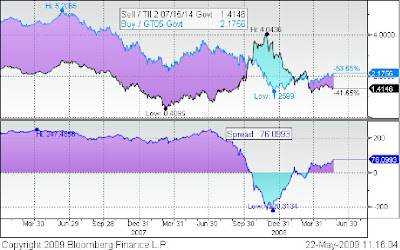

The above chart illustrates the breakeven inflation rate between the TII 2% 7/15/14 and the generic 5-year Treasury. Breakeven rate is currently 0.76%. That means that inflation needs to have that annual average over the next 5 years to make an investor indifferent to owning the nominal 5-year versus the TIP. If inflation is higher, the TIP is the better investment.

Breakevens are simply the market consensus on what inflation is expected over the coming 5 years. Considering all the talk about current Fed and Tsy policy leading to inflation, the bond vigilantes seem a bit less concerned.

True, the market is no longer pricing in outright deflation as it did post the Lehman bankruptcy but the inflation outlook, considering all the stimulus, is sitting well below the 2% breakeven inflation rate prior to the current downturn.

Interestingly, but not surprising, the pull back from the brink is similarly reflected in recovering equity and credit markets. Namely, depression pricing is out but no one is yet willing to make the bet on full recovery. If you are instead more upbeat on the outlook, there is plenty of upside left for investors in the credit and equity markets -- and TIPs are generally a good buy versus Treasurys.

While the market is not yet ready to price in recovery, the markets are still discounting 100bps of tightening by the Fed over the next 12 months. Go figure -- if inflation is less than 1% going forward count on the Fed staying right where it is. And if past is prologue, the Fed will be quantitatively easing long after it needs to. If you think, on the other hand, that the Fed might have to tighten to support the dollar think again. Not only won't they, a weaker dollar is part of the recovery program.

No comments:

Post a Comment